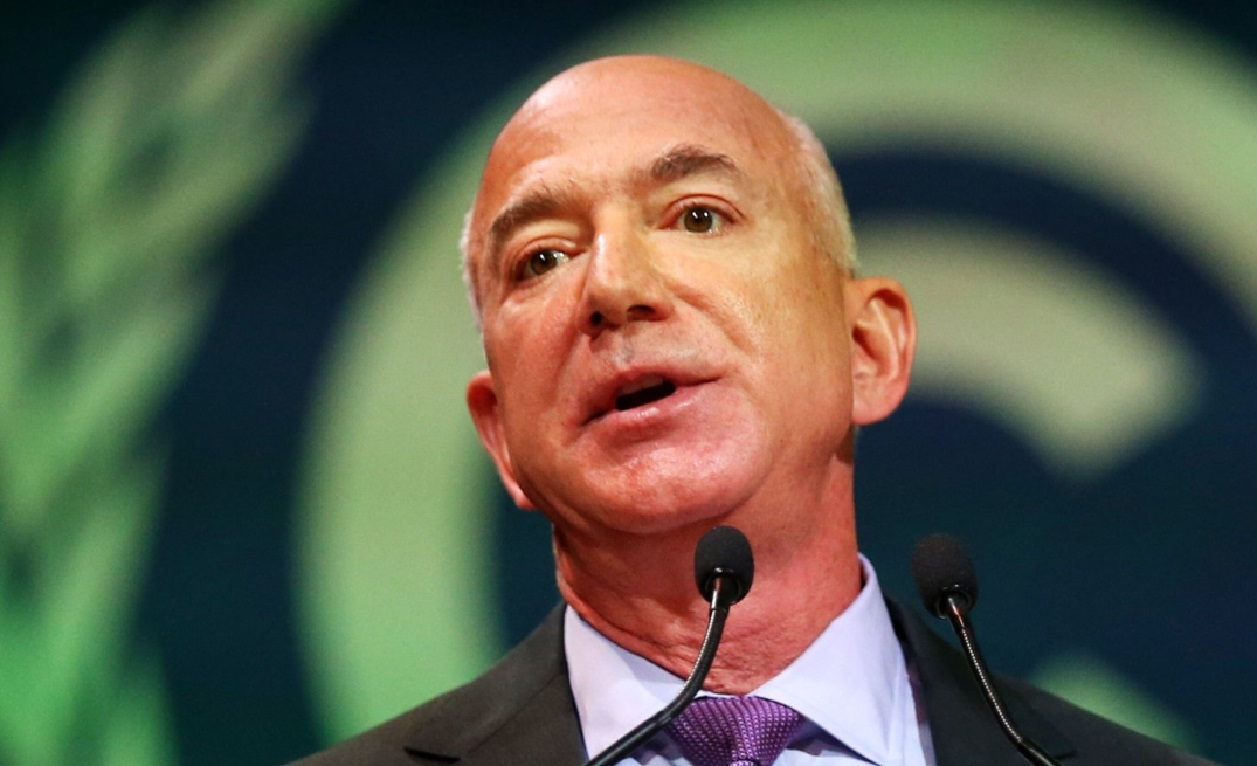

Jeff Bezos sold another 14 million Amazon shares worth about 2 billion USD and completed his plan to offload stocks worth 8.5 billion USD.

In November of this year, the technology giant announced that Bezos would sell up to 50 million shares in the next year. His sales of Amazon shares come after their price has surged more than 76% in the past year.

Jeff Bezos, who is the company’s founder and executive chairman, also sold shares in Amazon in 2021. He has also given away shares in the company as part of his philanthropy, most recently in 2022.

Jeff Bezos settled in Miami, Florida, from Seattle, Washington, last year and will save nearly 600 million USD in taxes on the 8.5 billion USD sale of the stock.

Gains over 250,000 USD from the sale of stocks or other long-term investments are taxed at 7% in Washington state, and Florida has no state income or capital gains taxes. However, Jeff Bezos will have to pay federal taxes as a result of the stock sale.

When Jeff Bezos announced his move, it sparked speculation that the reason was related to possible taxes he would have to pay in Washington after the state approved a new tax on large stock sales.

Jeff Bezos said in November that his parents had recently moved to Miami, where he spent part of his childhood, and he wanted to be near them and his Blue Origin space project, which is “increasingly shifting to Cape Canaveral”.

Jeff Bezos remains the largest shareholder in Amazon and is one of the richest people in the world with a fortune of more than 190 billion USD.

The unexpected sale of shares does not mean that he doubts their future value.

Stock price growth is prompting executives to sell more tech stocks after several quiet years. In October, Apple CEO Tim Cook undertook his biggest share sale in two years. A month later, Mark Zuckerberg sold Meta shares for about 400 million USD. Since December, Alphabet CEO Sundar Pichai has sold shares five times.

But when we evaluate the trades in terms of the number of shares sold instead of their dollar value, they look more conventional. Jeff Bezos has done bigger sales than the current one in the past. In 2020, the year after his divorce, he sold 80 million shares. The sales this year are part of a planned sell-off, not an instinctive reaction to market peaks.

What has changed is Amazon’s market value, which has doubled since the end of 2022. The sales are also noteworthy because 2022 and 2023 were very quiet. Amid the selloff in tech stocks, executives sold less than 11 billion USD in tech stocks in 2022, less than a third of total sales the year before, according to data from Verity.

Super sellers, executives at major technology companies who receive a large portion of their salary in the form of stock, led the sales. Jeff Bezos has chosen to stop selling shares for the first time in ten years. The exception was Elon Musk, who made a big selloff of Tesla stock to finance the purchase of Twitter.

Cost-cutting efforts, a pause in rate hikes and excitement over potential gains from artificial intelligence have led to a recovery in the sector’s share prices. We can get a better sense of how long-term executives believe the growth will last by looking at changes in their stakes in these companies.

Jeff Bezos has been reducing his stake year after year. The latest share sale did not result in a notable change. Nvidia CEO Jensen Huang sold shares last September for the first time in over a year by exercising options. But his stake in the company has barely changed over the past five years. Both remain the largest individual investors in their companies.

All of this should reassure shareholders that the share sell-off is not a signal that the market is topping out.